are 529 contributions tax deductible in oregon

529 Savings Plan Cons. Only the account owner can deduct their contributions to this 529 account.

529 Tax Deductions By State 2022 Rules On Tax Benefits

Lectronic Latitude is published online three times a week.

. Those tax-advantaged accounts work in tandem with high-deductible health plans HDHPs. 1 any remuneration other than an excess parachute payment in excess of 1 million paid to a covered employee by an applicable tax-exempt organization for a taxable year and 2 any excess parachute payment separation pay as specified in the bill. Instead of deductions some states offer a tax credit which may be more advantageous than a deduction depending on your amount of.

Money grows over time and can be withdrawn tax-free for higher education expenses. Upon reading this article which answer would the largest number of Guardian readers not you but Guardian readers choose in answer to the Guardians question. The tax is equal to the product of the corporate tax rate 21 under this bill and the sum of.

Funds must be used for eligible higher education expenses or else penalties will apply to withdrawals. Heres an article from The Guardian news section that would be interesting to do a social science experiment upon. Congress clarified the tax treatment of forgiven PPP loans and the deductions paid by those loans in the December 2020 stimulus act Sec.

States That Offer Tax Credits for 529 Plan Contributions. Some states that sponsor 529 plans let you make tax-deductible contributions or receive tax credits up to certain limits. Confused about tax brackets and tax rates or which filing status to choose.

Woman and man sitting together on the couch going through their finances and looking up how to cash out a 401k. A tax credit that is afforded to every man woman and child in America by the IRS. Legal deductions are capped at 3000 per year for single filers and 6000 per year for joint filers.

For example contributions to a New York 529 plan of up to 5000 per year by an individual or 10000 per year by a married couple filing jointly are deductible in computing state. For the 2021 tax year you could contribute up to 3600 to an HSA up to 7200 for family coverage. 18-0300 40 WTD 039 2021 04052021.

However Indiana Utah and Vermont offer a state income tax credit for 529 plan contributions and Minnesota offers a state income tax deduction or tax credit depending on the taxpayers adjusted gross income. Seven states allow tax-deductible contributions into 529 plans sponsored by any state. Fees vary and can be high.

This credit allows each person to gift a certain amount of their assets to other parties. A 529 plan allows you to save for college or higher education while receiving some type of tax benefit. If I make the qualified business income reduced tax rate QBIRTR election can I carry forward the Oregon 529 contributions subtraction I.

However some states may consider 529 contributions tax deductible. Some even allow you to make tax-deductible contributions up to their 529 plan contribution limits. Some states offer tax benefits.

Unified Tax Credit. Prepare early for the high costs of college. 529 plan state income tax benefits Over 30 states including the District of Columbia currently offer a state income tax credit or deduction up to a certain amount.

The most common benefit offered is a state income tax deduction for 529 plan contributions. Couple sitting at home on sofa discussing if political donations are tax deductible. To qualify for the HR Block Maximum Refund Guarantee the refund claim must be made during the calendar year in which the return was prepared and the larger refund or smaller tax liability must not be due to incomplete inaccurate or inconsistent information supplied by you positions taken by you your choice not to claim a deduction or.

529 Plan Tax Benefits by State. Go to wwwrevenuestatemnus and enter Free Tax Preparation into the Search box Call 651-297-3724 or 1-800-657-3989 Do I qualify. You may be eligible for a refund based on your household income see pages 8 and 9 and the property taxes or rent paid on your primary residence in Minnesota.

Only the account owner is allowed to deduct any contributions to a. We deny the petition. Latitude 38 is the founder of the Baja.

A medical services provider protests the Departments assessment of service and other activities BO tax on federal incentive payments. To find a volunteer tax preparation site. Taxpayer argues the incentive payments are deductible from BO tax as deductions or contributions.

529 Savings Plan Pros. Colorado Contributions to in-state 529 plans deductible without limit. Latitude 38 is the Wests most popular sailing and marine magazine published in print monthly.

Never are 529 contributions tax deductible on the federal level. Fifth Third Bank 5 Vanguard No No 5-6 business days after contribution and 10 business days for change of address or account holder No Yes 10000. Nebraska State Statute 77-1401 implements the federal ABLE Act in Nebraska.

5000 if married filing separately of contributions are deductible for Nebraska individual income tax purposes. Connecticut Contributions up to 5000 per year per person are deductible. Check with your 529 plan or your state to find out if youre eligible.

Yes expenses are tax deductible for the IRS or Oregon. Are political donations tax deductible. Limits on annual 529 state income tax benefits.

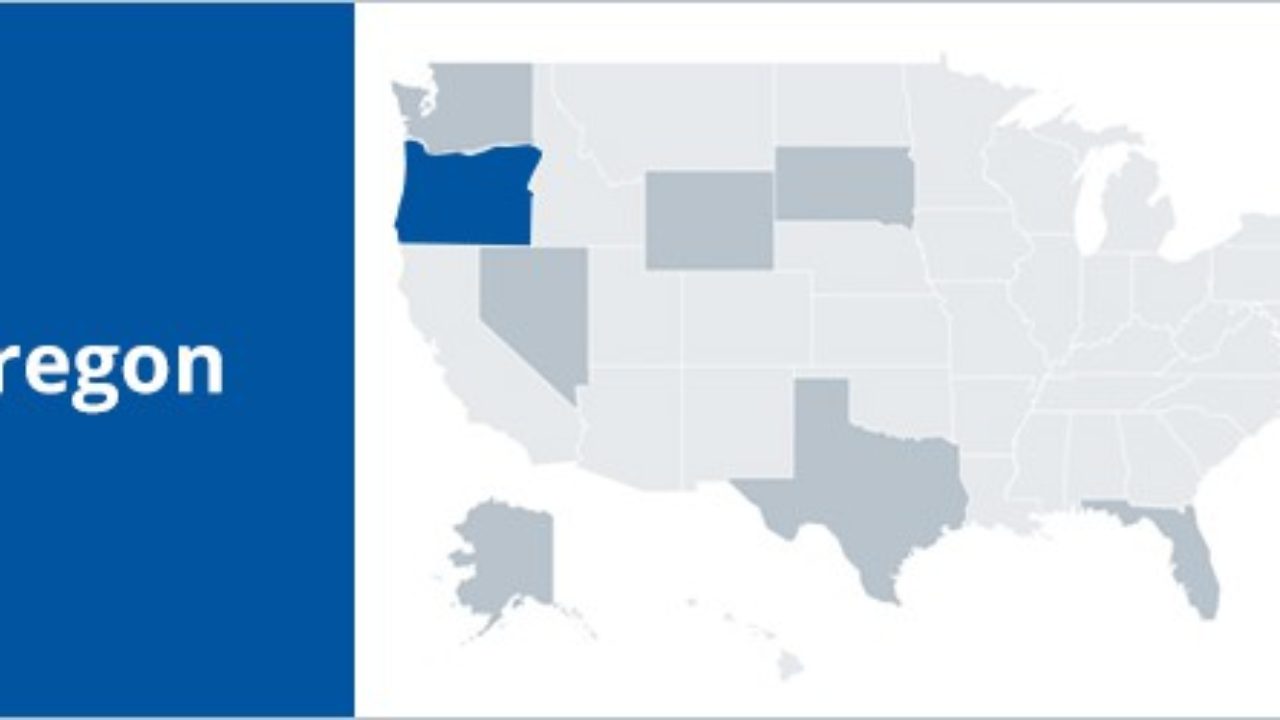

Oregon 529 Plan And College Savings Options Or College Savings Plan

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

Oregon 529 Contribution I Thought Oregon Gave A Tax Break For 529 Contributions But My Turbotax Premier Version Does Not Give Me A Place To Enter It

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

Tax Benefits Oregon College Savings Plan

529 College Savings Plans All 50 States Tax Benefit Comparison Updated 2021 My Money Blog

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

How Much Is Your State S 529 Plan Tax Deduction Really Worth Savingforcollege Com

Saving For College The Oregon College Savings Plan The H Group Salem Oregon

The Top 9 Benefits Of 529 Plans Savingforcollege Com

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans State Tax 529 College Savings Plan

Tax Benefits Oregon College Savings Plan

Tax Benefits Oregon College Savings Plan

The Or 529 Plan No More Tax Deduction For Savers Springwater Wealth Management

Where S My Oregon State Tax Refund Oregon Or Tax Brackets

How Do I Choose A 529 Morningstar 529 College Savings Plan College Savings Plans Saving For College

529 Plans Which States Reward College Savers Adviser Investments